Building Resilient Supply Chains Amid the Automotive Microchip Shortage

In recent years, the global automotive industry has been shaken by a persistent microchip shortage, halting production lines, escalating costs, and testing the resilience of even the most sophisticated supply chains. As vehicles increasingly rely on electronic control units, sensors, and advanced infotainment systems, the demand for semiconductors has surged. But supply has struggled to keep pace, exposing vulnerabilities across Original Equipment Manufacturers (OEMs), Tier-1 suppliers, and their broader supply networks.

To thrive in this high-stakes environment, supply chain and procurement leaders must rethink their approach to inventory planning, sourcing strategies, and financial collaboration. This article explores how multi-tier inventory buffering, dual-sourcing practices, and financial tools such as inventory financing can safeguard production continuity while optimizing working capital.

Why Automotive Microchips Are a Unique Risk

Automotive electronics differ from those used in consumer devices. Chips used in vehicles must meet rigorous reliability, temperature tolerance, and safety certifications, often requiring bespoke manufacturing processes. As a result, automakers cannot simply swap in general-purpose semiconductors when shortages strike.

Moreover, unlike smartphones or laptops that refresh every year, automotive platforms typically stretch over five to ten years. This long lifecycle demands a consistent chip supply across model generations. Compounding the problem, many automakers depend on sole-source suppliers, leaving them exposed when a fab goes offline or when geopolitical disruptions arise.

The tight coupling between chip supply and vehicle production means that any disruption cascades through the system. In this context, reactive procurement strategies are no longer viable. The future of supply chain resilience lies in proactive planning, starting with inventory buffers.

Multi-Tier Inventory Buffers: Building Slack into the System

Multi-tier buffering involves strategically placing safety stock at several points across the supply chain. Not just at the assembly plant, but also at regional distribution centers and upstream supplier locations. This distributed buffer acts as a shock absorber during demand surges or upstream disruptions.

For example, maintaining a rolling three-week chip buffer at the plant, complemented by a five-week reserve at Tier-1 suppliers, can offer a cushion when lead times extend unexpectedly. The key is to dynamically balance buffer size with the cost of capital, storage, and obsolescence risk.

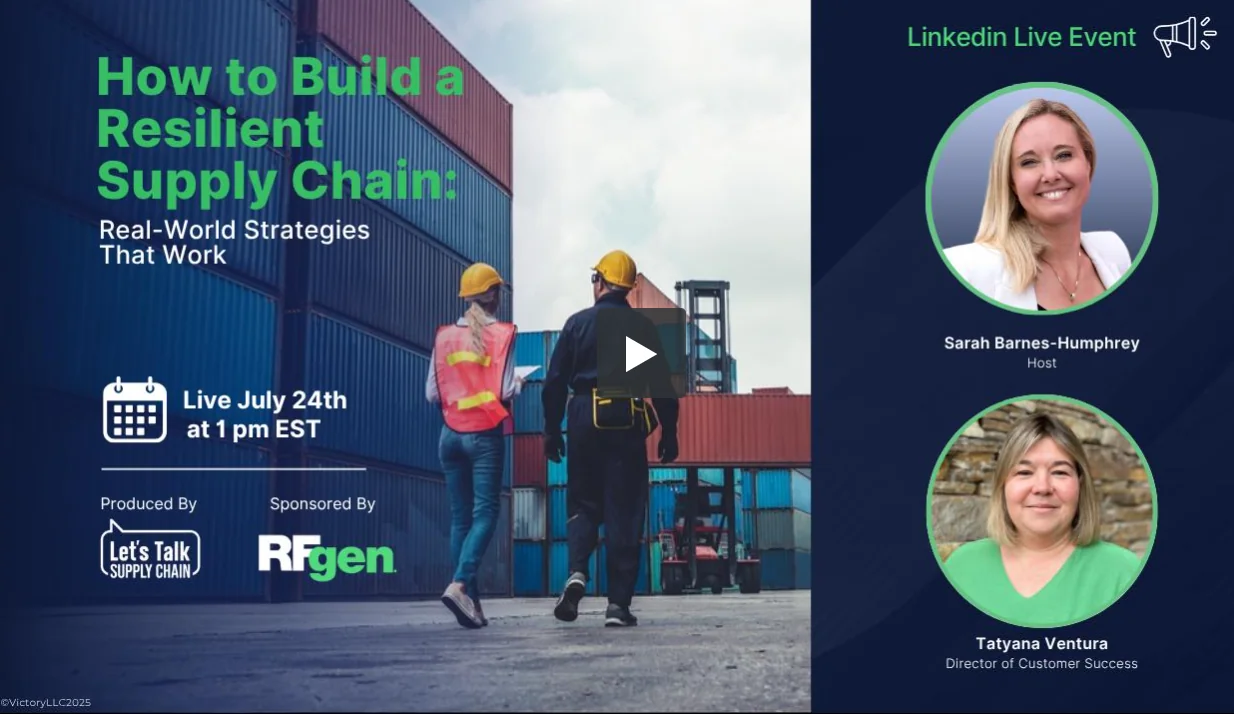

Modern inventory systems can support this approach by enabling real-time visibility, generating threshold-based alerts, and integrating seamlessly with ERP platforms. RFgen’s mobile inventory tracking tools are one example of how companies are improving transparency across facilities.

Dual Sourcing: Mitigating Sole-Supplier Risk

The pandemic and chip shortage revealed the peril of over-reliance on a single supplier. Dual sourcing, establishing secondary (and even tertiary) vendors for key components, is now a best practice for de-risking supply.

Effective dual sourcing includes:

- Pre-qualifying vendors based on quality, compliance, and geographic risk factors

- Contractual commitments that guarantee a minimum supply volume

- Periodic reviews and test orders to ensure readiness when a switch is needed

Dual sourcing should extend beyond Tier-1 to Tier-2 and Tier-3 suppliers. If a Tier-1 provider is diversified but its sub-supplier of chip substrates is not, your risk exposure remains high. Transparency and digital collaboration tools help trace the provenance of high-risk parts across the supply web.

Financial Agility: Making Finance a Strategic Supply Chain Partner

It is no longer enough to plan inventory based solely on production schedules. Financial constraints (e.g. interest rates, cash flow, and supplier liquidity) now play a central role. According to J.P. Morgan’s insights on inventory finance in the automotive supply chain, tools like inventory financing, reverse factoring, and working capital optimization are increasingly essential.

Here are three core financial agility strategies to consider:

1. Inventory Financing to Free Up Cash

Holding buffer inventory comes at a cost, especially with rising interest rates. Inventory financing allows OEMs or Tier-1 suppliers to borrow against the value of chip inventories while deferring cash outlay until the chips are used in production. This approach improves liquidity and reduces the strain on cash flow.

2. Reverse Factoring to Support Tier-2 and Tier-3 Liquidity

Many upstream suppliers operate on thin margins. If they struggle financially, the entire production chain is at risk. Reverse factoring enables OEMs to use their stronger credit profile to help small suppliers get paid faster at lower financing rates. This ensures supplier stability and preserves long-term relationships.

3. Joint Finance-Operations Planning

Finance and supply chain leaders must collaborate to model tradeoffs between inventory levels, cost of capital, and production continuity. With integrated systems in place, teams can simulate what-if scenarios, such as the ROI of adding another week of buffer inventory versus tying up an additional $5 million in parts.

When financial data is connected to inventory systems, it becomes easier to make stocking decisions based not just on operational urgency, but on true business impact. RFgen’s integration with ERP systems enables a shared view of inventory velocity and safety thresholds across both finance and operations.

Enabling Technology: Visibility Across Every Tier

Real-time inventory visibility is no longer a luxury. It is a necessity. When chip supplies tighten, detection delays can trigger cascading disruptions. Mobile inventory platforms provide on-the-floor data collection, barcode-enabled tracking, and seamless synchronization with enterprise systems.

Key features that support resilient inventory management include:

- Threshold-based alerts for low inventory

- Supplier portal integration for upstream visibility

- Predictive analytics based on historical patterns and incoming orders

These capabilities make it easier to manage safety stock, dual sourcing, and supplier coordination while reducing reliance on manual processes and reactive planning.

Real World Scenarios Driving Resilience

- Demand Shock from Electrification and Digitization

As vehicles shift from mechanical machines to software-and-silicon platforms, chip content per car explodes. Electric vehicles, advanced driver assistance, connected services, and richer infotainment systems create layered, overlapping demand drivers. A mid-cycle OEM that suddenly needs orders of power management, sensor processing, and AI inference chips finds its forecasted chip demand rising faster than planned capacity, stressing traditional procurement models. - Supply Disruption and Strategic Resilience

The 2020–2022 global shortage made clear that semiconductors were mission critical. In this scenario, a supplier reliant on a single geographic source sees lead times spike and risk of production stoppage. The response is layered: qualify a second source in a different region, institute multi-tier safety stock (e.g., held both at the plant and upstream with partners), and deploy real-time inventory/ERP alerts so procurement can shift before stockouts occur. The result is continuity while peers scramble. - Geopolitical Fragmentation and Localized Supply Strategy

Regional policy shifts—Europe pursuing semiconductor sovereignty, China emphasizing domestic chip sourcing, and North America investing in advanced fabrication—create a fragmented global landscape. A global Tier-1 supplier recalibrates its sourcing map to balance compliance, latency, and risk: some chip families are localized to meet regulatory/market pressures, others are dual-sourced across regions to hedge against geopolitical disruptions. - Technology Evolution Driving Complexity and Opportunity

Innovation embeds more capability into fewer packages: system-on-chip and AI accelerators handle autonomy and sensor fusion in real time, while power-efficient architectures stretch EV range. This increases integration risk (a failure affects multiple subsystems) but also creates leverage for suppliers who can offer consolidated, validated chip solutions—pushing OEMs to adopt “chip-first” vehicle design where availability and specification of key semiconductors shape architecture decisions up front.

Roadmap: 5 Steps to Building a Resilient Chip Supply Chain

- Map Critical Components and Suppliers

Identify all semiconductors and related components that are sole-sourced or high-risk. Trace upstream to Tier-2 and Tier-3 suppliers. - Establish Multi-Tier Buffers

Define safety stock levels for each critical part across plants, warehouses, and supplier locations based on historical lead times and risk tolerance. - Implement Dual-Sourcing Frameworks

Qualify and contract with alternate chip suppliers. Set cadence for routine testing and performance reviews. - Integrate Finance into Inventory Planning

Collaborate with finance to evaluate the cost-benefit of inventory decisions. Consider tools like inventory financing and reverse factoring. - Deploy Real-Time Visibility Tools

Use mobile and ERP-integrated platforms to track inventory and trigger alerts across multiple tiers.

Final Notes

The automotive microchip shortage may persist for years, but it also presents an opportunity to modernize supply chain operations. By embracing multi-tier inventory strategies, diversifying suppliers, and aligning with finance on working capital priorities, automotive leaders can move from reactive firefighting to resilient planning.

The ripple effects of the microchip shortage extend far beyond the factory floor. Semiconductors are becoming central to how automakers design and differentiate their vehicles, from advanced driver-assistance systems to energy-efficient powertrains. As automotive electronics evolve, they are driving long-term innovation across the industry. At the same time, limited chip availability continues to impact dealership inventory and pricing, with vehicle costs rising and lead times stretching. Understanding both the technological transformation and the economic consequences offers vital context for supply chain and procurement leaders aiming to build resilience.