AI Readiness for Costpoint Leaders: Building the Foundation for Intelligent Operations

Mobile-First UX for SAP EWM: Why Warehouses Need a New Approach to Retention and Productivity

Building Resilience in Costpoint Manufacturing: Rethinking the Workforce Gap

EWM 2025 Executives Guide to Warehouse Mobility and Efficiency

FSMA 204 Extension: Digital Traceability that Delivers ROI Before 2028

FSMA 204's extension to July 20, 2028 lets ops, quality, and IT standardize GS1/EPCIS, pilot mobile traceability, cut recall risk, and fund rollout with ROI.

Read MoreAI Readiness For Supply Chains Starts With Mobile Barcoding

Learn what true AI readiness means for supply chains and how RFgen helps Oracle users digitize frontline operations to prepare for advanced AI and analytics.

Read MoreData Integrity in the Supply Chain: The Hidden Factor Behind AI Accuracy

Discover why data integrity is the unsung hero of AI in supply chain management, and how RFgen helps Oracle users ensure clean, accurate, and actionable...

Read MoreAI Adoption in Supply Chains: From Agents to Mobile Execution

A practical, ERP-inclusive guide to adopting AI agents in supply chains and turning insights into action with mobile execution.

Read MoreWhy Supply Chains Need Clean, Real-Time Edge Data for AI Accuracy

Bad edge data = bad AI. How barcode-driven, real-time capture and RFgen’s Oracle Cloud/EBS integrations stop GIGO and fuel better analytics, agents, and decisions.

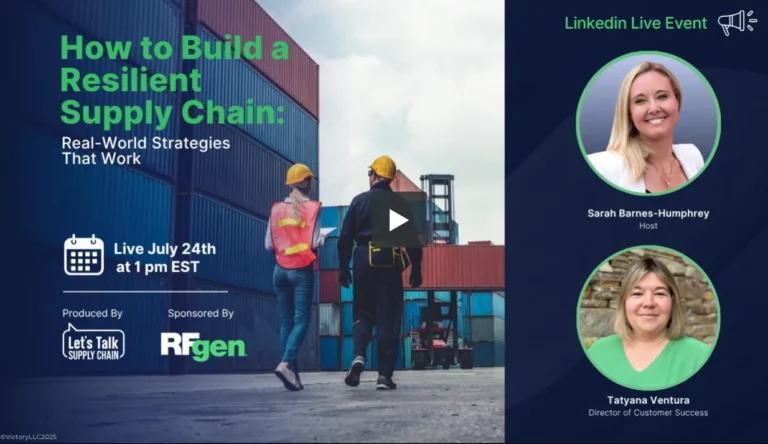

Read MoreWebinar: Resilience Strategies That Build Trust in Supply Chains

Build resilience in permanent disruption with real time visibility, smart inventory, responsive warehousing, and practical steps leaders can apply today.

Read MoreBuilding Resilient Supply Chains Amid the Automotive Microchip Shortage

Learn effective measures to build supply chain resilience during the ongoing automotive chip shortage and secure your future.

Read More